utah state tax commission forms

Ad Free 2021 Federal Tax Return. E-File Directly to the IRS State.

Mmddyyyy Save postage a check.

. Utah state income tax Form TC-40 must be postmarked by April 15 2021 in order to avoid penalties and late fees. You cannot use TAP to file amended returns. Ad Free For Simple Tax Returns Only With TurboTax Free Edition.

Salt Lake City UT 84134-0266 RETURNS to. Do not send this form with your return. Get form TC-40E Renewable Residential and Commercial Energy Systems Tax Credits from the Governors Office of Energy Development with their certification stamp.

Printable Utah state tax forms for the 2020 tax year will be based on income earned between January 1 2020 through December 31 2020. It does not contain all tax laws or rules. Attach completed schedule to your Utah Income Tax return.

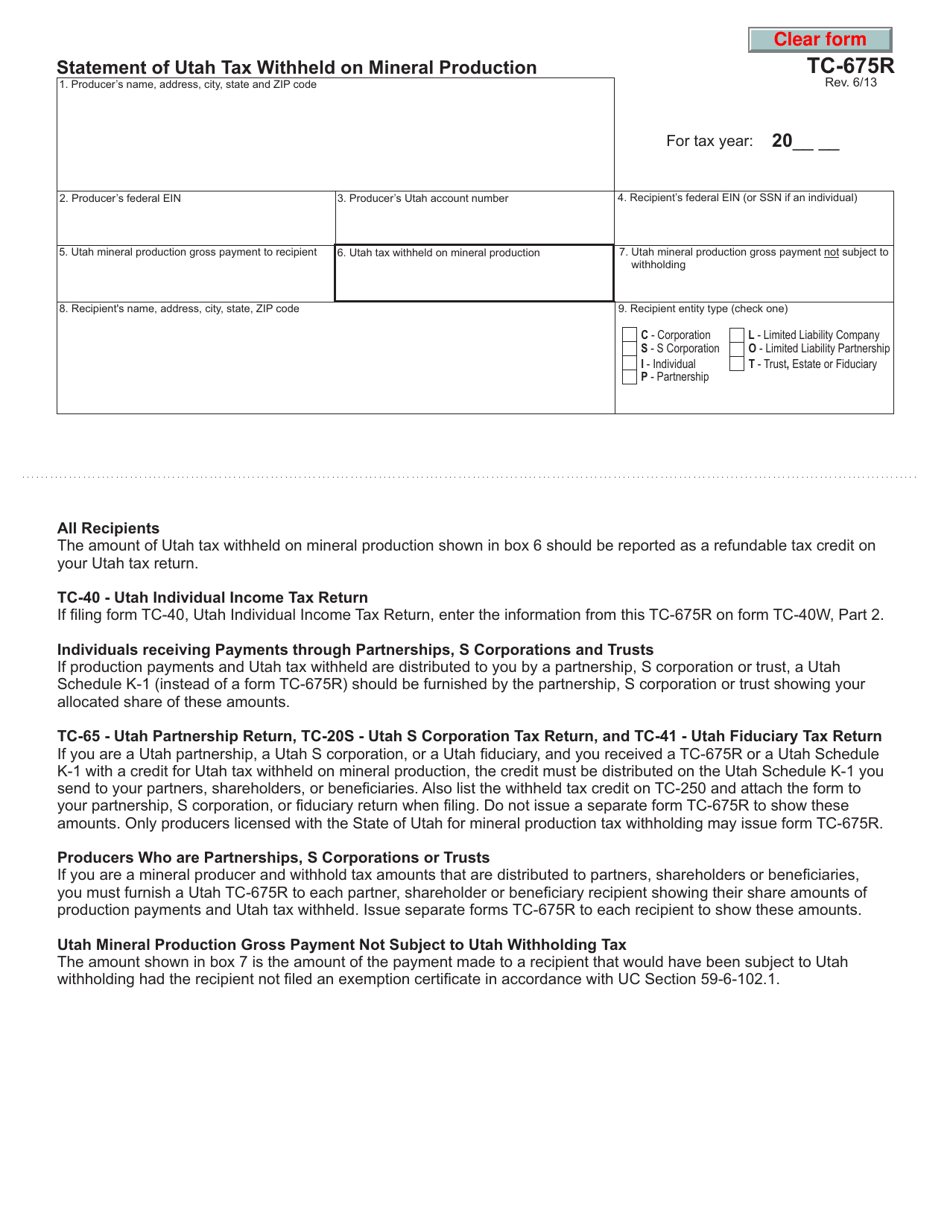

You may prepay through withholding W-2 TC-675R 1099-R etc payments applied from previous year refunds credits and credit carryovers or payments made by the tax due date using form TC-546. Official information about taxes administered in the State of Utah by the Utah State Tax Commission. For security reasons TAP and other e-services are not available in most countries outside the United States.

Make a copy for your records. Third quarter July-Sept 2020 quarterly filers September 2020 monthly filers Jan Dec 2020 annual filers. USTC ORIGINAL FORM 40103 y y.

File electronically using Taxpayer Access Point at taputahgov. File electronically using Taxpayer Access Point at taputahgov. Utah State Tax Commission taxutahgov 210 N 1950 W Salt Lake City UT 84134-0400 Sales and Use Tax Return Acct.

File online at taputahgov Check here if this is an AMENDED return. Return the original form. Please contact us at 801-297-2200 or taxmasterutahgov for more information.

Keep the form and all related documents with your records to provide the Tax Commission upon request. Third quarter July-Sept 2020 quarterly filers September 2020 monthly filers Jan Dec 2020 annual filers. Please contact us at 801-297-2200 or taxmasterutahgov for more information.

Get prior year forms and instructions at taxutahgovforms. Ad Fill Sign Email TC-941 More Fillable Forms Register and Subscribe Now. It does not contain all tax laws or rules.

Utah State Tax Commission 210 N 1950 W Salt Lake City UT 84134-0266 ALL OTHER RETURNS including refunds Utah State Tax Commission 210 N 1950 W Salt Lake City UT 84134-0260 Utah Taxpayer Advocate Service The Taxpayer Advocate Service helps taxpayers who have made multiple unsuccessful attempts to resolve concerns with the Tax Commission. The Utah income tax rate for tax year 2020 is 495. Centrally Assessed Natural Resources.

The current tax year is 2021 and most states will release updated tax. Import Your Tax Forms And File For Your Max Refund Today. For security reasons TAP and other e-services are not available in most countries outside the United States.

E-FIle Directly to Utah for only 1499. E-File Free Directly to the IRS. Official site of the Property Tax Division of the Utah State Tax Commission with information about property taxes in Utah.

Get A Jumpstart On Your Taxes. For security reasons TAP and other e-services are not available in most countries outside the United States. Please allow three working days for a response.

See also Deadlines to Claim a Refund or Credit. Mail Utah State Tax Commission Mail Utah State Tax Commission RETURNS WITH 210 N 1950 W ALL OTHER 210 N 1950 W PAYMENTS to. Official website of the Utah Motor Vehicle Enforcement Division a Division of the Utah State Tax Commission.

The official site of the Division of Motor Vehicles DMV for the State of Utah a division of the Utah State Tax Commission. Mine Discounted Cash Flow Questionnaire Instructions. Utah has a flat state income tax of 495 which is administered by the Utah State Tax CommissionTaxFormFinder provides printable PDF copies of 56 current Utah income tax forms.

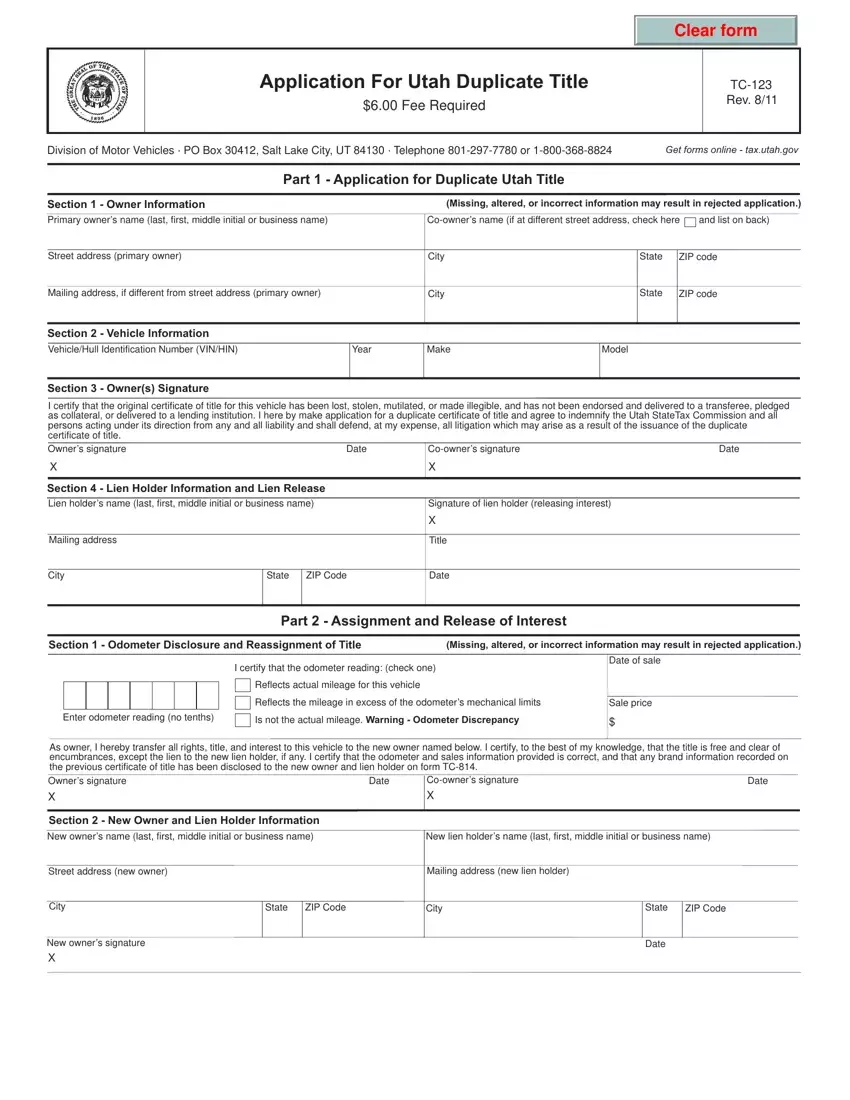

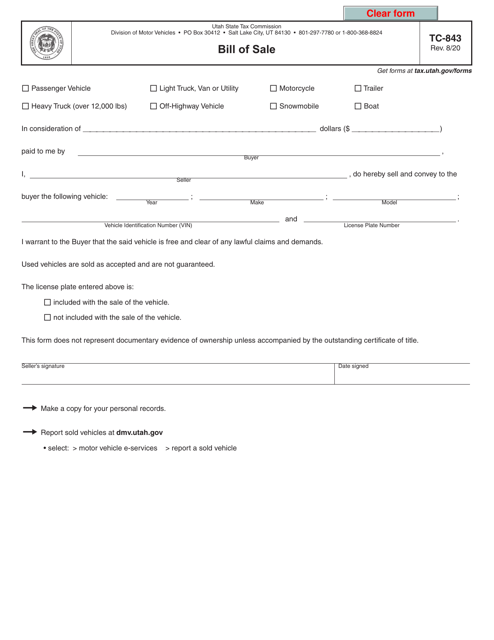

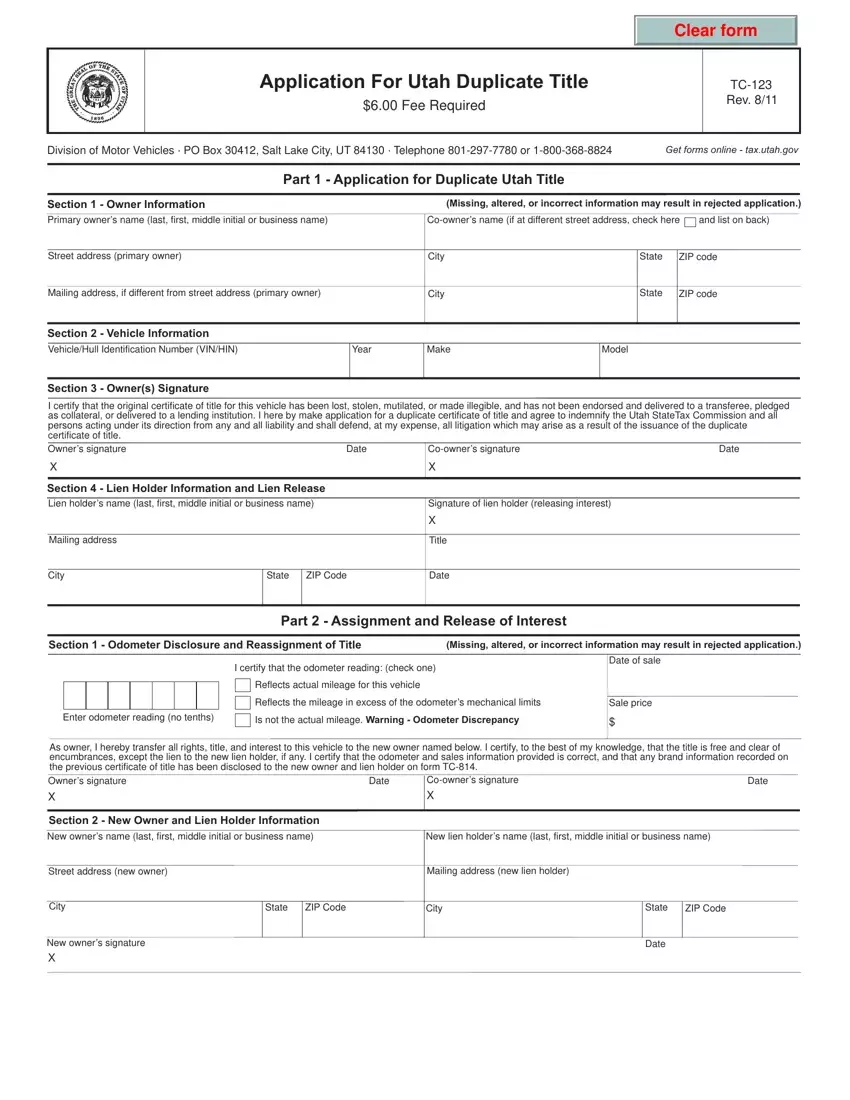

It does not contain all tax laws or rules. Salt Lake City UT 84134-0260 Submit page ONLY if data entered. Utah State Tax Commission Division of Motor Vehicles PO Box 30412 Salt Lake City UT 84130 801 297-7780 or 1-800-368-8824 If you need an accommodation under the Americans with Disabilities Act contact the Tax Commission at 801 297-3811 or TDD at 801 297-2020.

It does not contain all tax laws or rules. Please contact us at 801-297-2200 or taxmasterutahgov for more information. All Utah sales and use tax returns and other sales-related tax returns must be filed electronically beginning with returns due Nov.

All Utah sales and use tax returns and other sales-related tax returns must be filed electronically beginning with returns due Nov. 90 percent of your 2021 tax due TC-40 line 27 plus line 30 if you did not have a Utah tax liability in 2020 or if this is your first year filing. Please contact us at 801-297-2200 or taxmasterutahgov for more information.

For security reasons TAP and other e-services are not available in most countries outside the United States. To amend a previously-filed return use the tax forms and instructions for the year you are amending. FROM mmddyyyy TO mmddyyyy Return Due Date.

Get Your Max Refund Today.

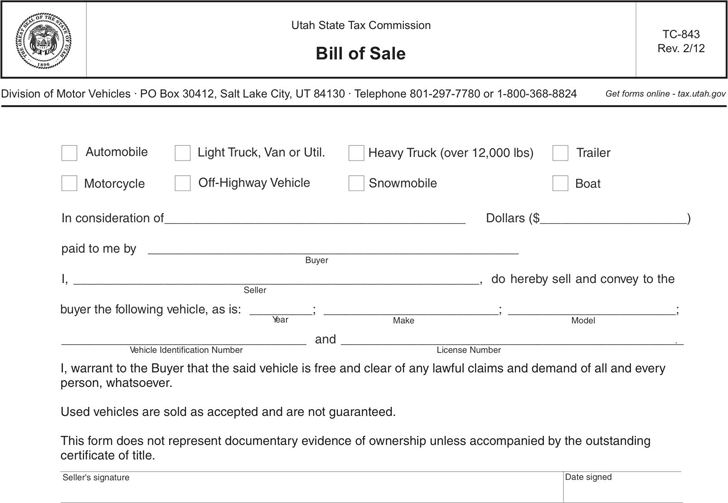

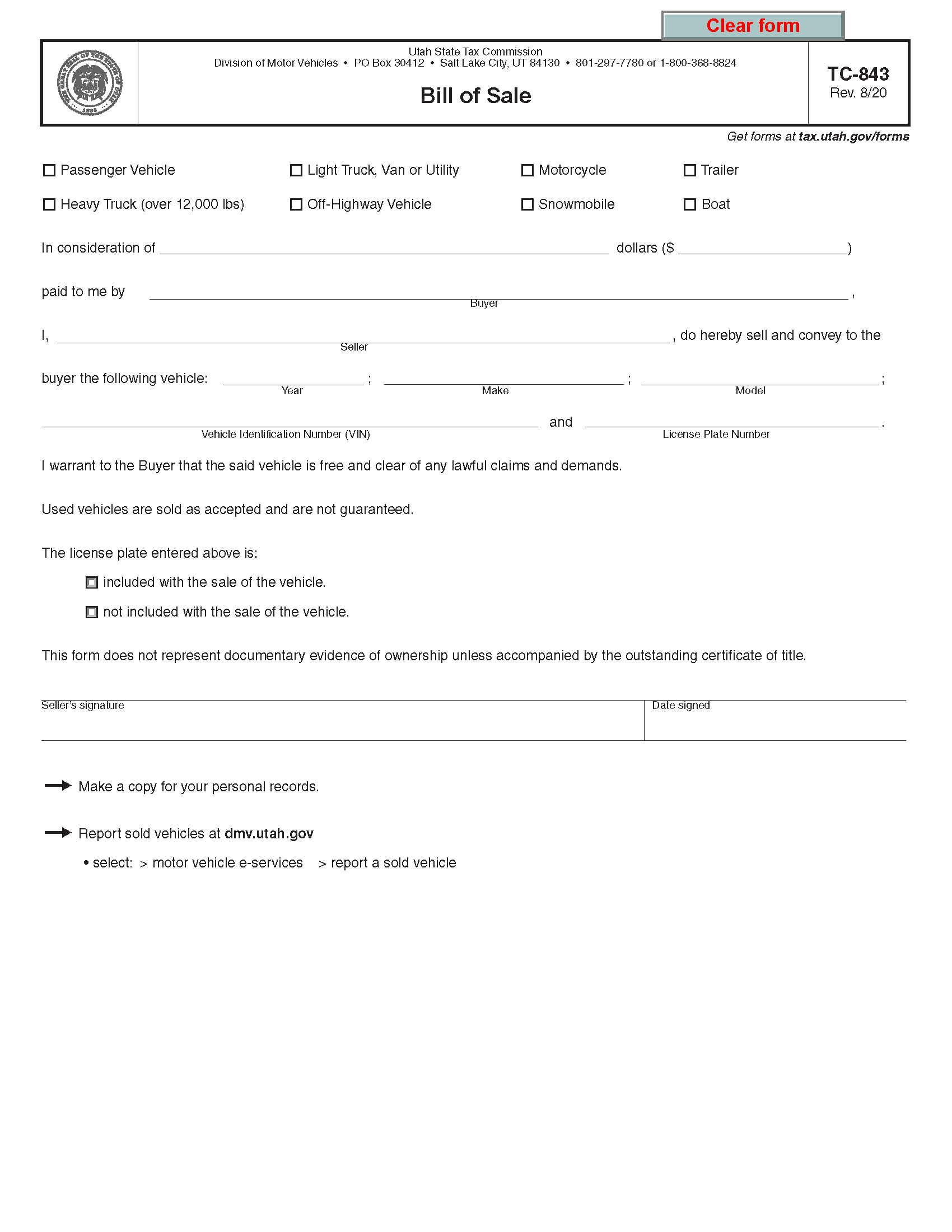

Free Utah Motor Vehicle Bill Of Sale Form Pdf 102kb 1 Page S

Printable Utah Income Tax Forms For Tax Year 2021

Form Tc 675r Download Fillable Pdf Or Fill Online Statement Of Utah Tax Withheld On Mineral Production 2013 Templateroller

Utah State Tax Commission Official Website

Utah Income Taxes Utah State Tax Commission

Utah State Tax Benefits Information

Free Utah Motor Vehicle Bill Of Sale Form Pdf Word

How To Get A Sales Tax Exemption Certificate In Utah

Utah Tc 123 Fill Out Printable Pdf Forms Online

Utah State Tax Commission Notice Of Change Sample 1

Form Tc 843 Download Fillable Pdf Or Fill Online Bill Of Sale Utah Templateroller

Dmv Form Tc 123 Fill Out Printable Pdf Forms Online

Utah State Tax Commission Notice Of Change Sample 1

Bill Of Sale Utah State Tax Commission Bill Of Sale Template State Tax Bills