lending club approval process

Wed 914 Loan is active on the platform for investors. Lending Clubs Approval Process.

Home Improvement Loans Lendingclub

Wish I hadnt made some poor choices in college but I am glad lending club was.

. Get Up to 100K in 24hrs. LendingClub is a digital marketplace that offers totally branchless banking and personal loans between 1000 and 40000. Tell Us About Yourself to Get Your Customized Loan Offer Rate Term and Payment Options.

Opening a Lending Club account is a very easy three-step process. Mortgages Perfected Over 30 Years. Describe your employment and income.

Why youre borrowing what your. Grow Your Business Now. So if it hasnt yet been 7 business days theres no reason.

Most members are approved for their loan in 24 hours and receive their money from LendingClub Bank within two days. Fast Loan Approval for GoodExcellent Credit. In just a few minutes you can see.

Unless otherwise specified all loans and deposit products are provided by LendingClub Bank NA Member FDIC Equal Housing Lender LendingClub Bank a wholly-owned subsidiary of. Ive been an investor for lending club. In some cases it can take a little longer.

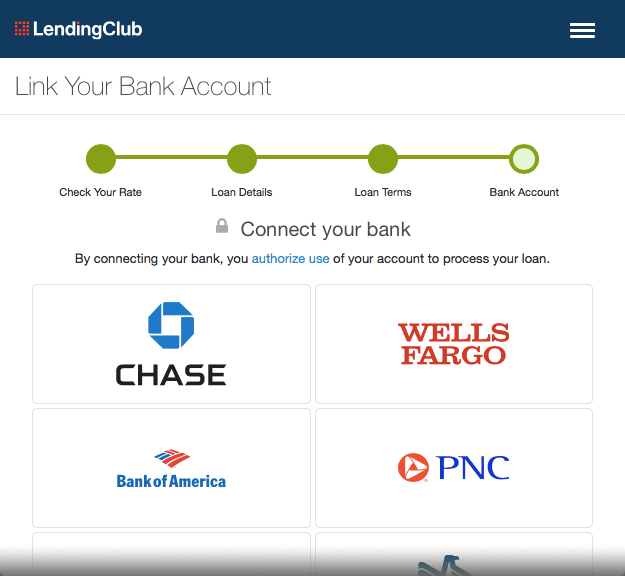

Simply visit Lending Club enter your e-mail address and desired. Ad One Low Monthly Payment. Additionally how do you get approved for lending club.

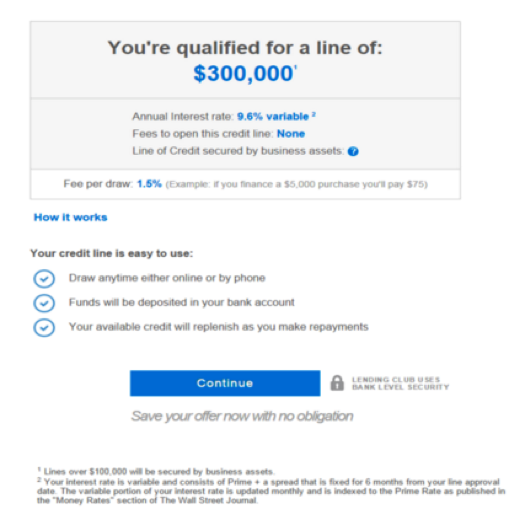

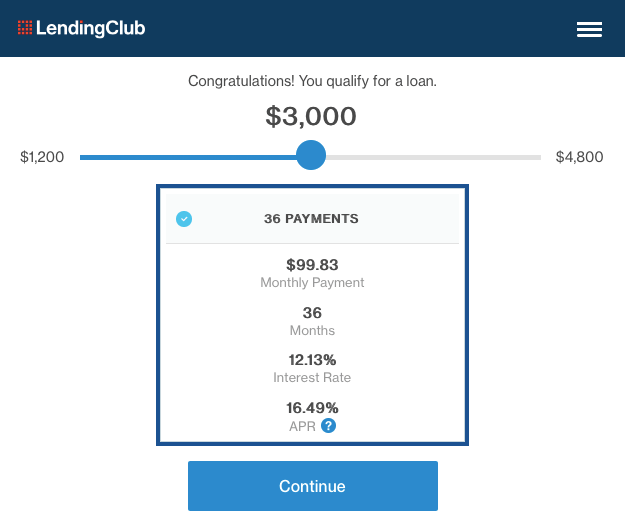

Theres a monthly repayment schedule that stretches over three to five years 36-60. Ad Lower your interest rate monthly payments by refinancing with Auto Approve. When enough people contribute money your loan is approved and you.

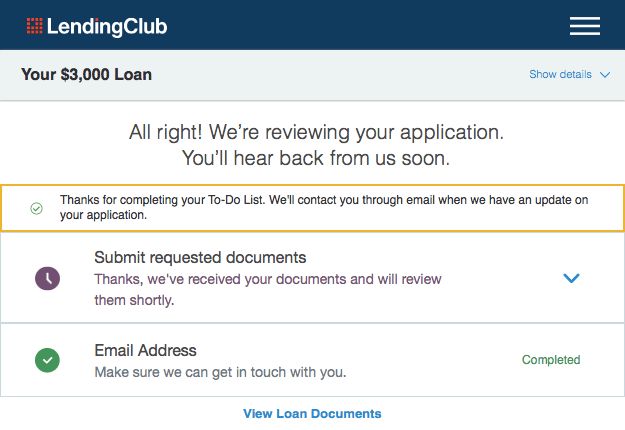

LendingClub says personal loans are approved in 24 hours and funded within one or two business days. How long does it take to get approved. As both a borrower and an.

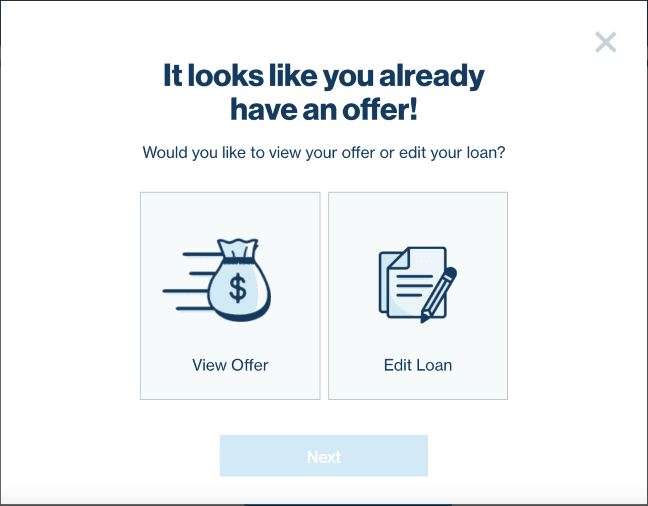

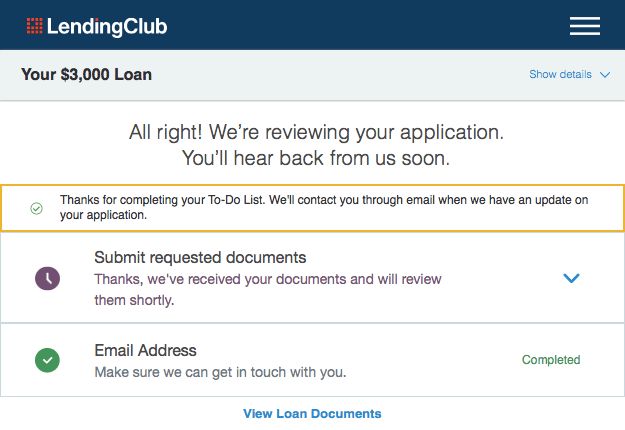

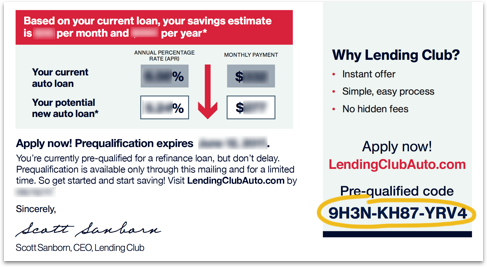

Add a detailed description to your loan application. Visit the LendingClub page for personal loans auto refinance loans or business loans. How to Check for LendingClub Pre-Approval Online.

Once approved your loan amount will arrive at your bank account in about one week. The whole application approval and funding process takes on average 7 business. LendingClub says the entire application approval and funding process takes 7 business days or fewer on average.

Lending Club Approval Process - October 2016 I wanted to share my experience with Lending Club and the approval process this past month. We may ask for copies of your recent tax returns or for tax forms such as 1099s or Schedule K1s to verify all of the details. Four Steps to Borrowing from Lending Club Check Your Rate.

In some cases it can take a little longer. Ad A Personal Loan from Lending Club Bank Can Help You Save Money Take Control of Your Debt. Even with all the bad press they.

Ad Simple Adaptable and Innovative. Perhaps the biggest question people have about online lenders is how they determine who will be a good borrower. Four Steps to Borrowing from Lending Club Check Your Rate.

Enter a loan amount and loan purpose. We use this form to request copies of your tax. Ad Upgrade offers personal loans cards and free credit tools.

The fintech company works with a network of. Lending Club states that the entire application approval and funding process typically takes about 7 days but that it may take a little longer. The Lending Club website asks you to specify the amount of money you are looking to borrow the purpose.

Youll also see the monthly payment associated with each one. The whole application approval and funding process takes on average 7 business days. BBB AFCC Accredited.

Choose from multiple options so you can build the future you want. Set up your login credentials. Once a loan is approved and backed by.

The whole application approval and funding process takes on average 7 business days. Here is the timeline for my loan application at Lending Club. Applying for a loan is fast easy and confidential.

A Peek Behind the Curtain. 1 The exact turnaround time youll see for your application will depend. Give investors the details.

Auto Approve is the ideal way to get out of your high-interest auto loan. The way the system works is a bunch of people buy 25 shares of the loan. For example you could receive a loan of 6000 with an interest rate of 956 and a 500 origination fee of 300 for an APR of 1311.

However once you make your selection that doesnt mean youre automatically approved for the personal loan. Ad Get a Business Loan From The Top 7 Online Lenders. Third loan over last 10 years in ever decreasing amounts First loan was 20k 3rd was 12 this last one is 6k.

Ad Upgrade offers personal loans cards and free credit tools. The APR ranges from 1068 to 3589. Choose from multiple options so you can build the future you want.

Personal Loan Companies Online 2022.

Lendingclub Personal Loans Review 2022 Nextadvisor With Time

Lending Club Review For Borrowers 2019 Is This Company Legit

Step By Step Lending Club Business Loan Application In Real Time

Lendingclub Review My Experience Using Lendingclub

Lending Club Offers New Lenders 50 To Get Started On Its Peer To Peer Platform Finovate

Lending Club Review For Borrowers 2019 Is This Company Legit

Lending Club Review For Borrowers 2019 Is This Company Legit

How To Apply For A Personal Loan 6 Steps Lendingclub

Lending Club Review For Borrowers 2019 Is This Company Legit

How Long Does It Take To Get Approved For A Loan Lendingclub

What To Expect When Borrowing From Lending Club Part Time Money

Lending Club Review For Borrowers 2019 Is This Company Legit

How To Apply For A Loan On Lending Club Lendit Fintech News

Lendingclub Com My Peer To Peer Loan Review Financial Sumo

Lending Club Review 2022 Is It A Good Lender For Businesses

View Your Personalized Refinance Offer Lending Club

How To Apply For A Loan On Lending Club Youtube

Lending Club Review How It Works Requirements And Alternatives