illinois electric car tax credit income limit

That cap would be 150000 for joint filers and 112500 for. Find Out Now If You Qualify.

The legislation dubbed the Reimagining Electric Vehicles in Illinois REV Act would offer enhanced tax credits modeled after the states Economic Development for a Growing Economy EDGE.

. However the Agency is directed by the law to prioritize the review of qualified applications from low-income purchasers and award rebates to qualified purchasers accordingly Who qualifies as low. If you plan to buy an EV that qualifies for the whole 7500 tax credit you may want to lower your monthly instalment payments to 1375. Those purchases also would come with income caps.

The income caps are much lower for used EVs and the purchase. Most electric vehicles will qualify for the full 7500 but for some plug-in hybrid models the credit amount can fall well below the maximum credit. Illinois EV rebate is not a tax credit though the federal government does offer a tax credit up to 7500 for certain electric vehicles and plug-in hybrids.

Illinois residents that purchase a new or used all-electric vehicle from an Illinois licensed dealer will be eligible for a rebate in the amounts set forth below. The bill would also create a used electric vehicle credit through 2032 capped at the lessor of 4000 or 30 percent of the sales price. The definition of electric vehicle specifically excludes off-road vehicles.

Do You Need To Set Up An Illinois State Payment Plan. A 4000 rebate for the purchase of an all-electric vehicle that is not an electric motorcycle. Were seeing more and more electrified vehicles EVs come to market.

The version proposed earlier on Oct. A clean energy bill that just passed in the state of Illinois has set a goal of adding 1 million. Most references say up to or have an asterisk the short answer is if line 16 on the standard IRS 1040 is above 7500 you get the full tax credit The long answer follows.

For couples the cap would be 300000 combined income. The credit amount begins to phase out if the taxpayers adjusted gross income is above certain thresholds. We look at which cars are eligible which buyers are eligible and how exactly this tax credit works.

Limited to 250 per door and 500 for all doors per taxpayer per year. Heres what you need to know. Is there an income limit for eligibility to receive the rebate.

Higher income limits to receive the full tax credit. State and municipal tax breaks may also be available. Sep 15 2021.

EV tax credits start to phase out at AGIs of 300000 married filing jointly 225000 head. It looks like all of Illinois should be covered under the 4000 rebate but not until July 2022. The EV tax credit is only available to buyers whose modified adjusted gross income is no more than 150000 in the year of purchase for.

For individuals the maximum income would be 250000 and for single-income households the income limit would be 375000. Httpswww2illinoisgovepatopicscejaPagesdefaultaspx Federal Tax Credit about that asterisk Currently there is a 7500 tax credit with the purchase of an electric Car. Many new electric vehicles and plug-in hybrids are eligible for a tax credit of up to 7500.

So you could spend up to 833 on an energy-efficient doorand 1667 on multiple energy-efficient doorsin a given year and still get the full credit since 30 833 250 and 30 1667 500. Find Out If You Qualify. How Much are Electric Vehicle Tax Credits.

16 Sep 2021 1258 UTC. Ad The future of driving is electric. The electric vehicle tax credit is set to change thanks to the Inflation Reduction Act of 2022.

28 would have provided a tax. Lets say you expect to owe a total of 24000 in taxes for the year before the EV credit and plan to pay instalments of 2000 a month. Individuals who make up to 150000 annually would be eligible for the credit.

Ad Do You Need To Set Up An Illinois State Installment Plan. Get more power than ever with Nissan Electric Vehicles. There is no income limit on eligibility.

Illinois sweeping new clean energy law includes a 4000 rebate on an electric car up to 10 off on your electric bill and up to 9000 back on. The time to go electric is now with Nissans Award-Winning Electric Car Lineup. All-electric and plug-in hybrid vehicles bought new in or after 2010 may be eligible for a 7500 federal income tax credit.

The amount of the credit will vary depending on the capacity of the battery used to power the car. It also seems like the bill isnt actually written in a way that all of the state would be covered but they will make it right before the July 2022 deadline. 150000 for married couples filing jointly 112500 for head of household and 75000 otherwise.

Individual tax filers with income above 75000 would be ineligible for the credit.

Ford Lightning Ev Tax Credits Rebates Discussion Ford Lightning Forum

How To Maximize Your Federal Tax Credit For Electric Cars In 2022 Financial Alternatives

How To Maximize Your Federal Tax Credit For Electric Cars In 2022 Financial Alternatives

Electric Vehicles Incentives Resources Ameren Missouri

Ford Lightning Ev Tax Credits Rebates Discussion Ford Lightning Forum

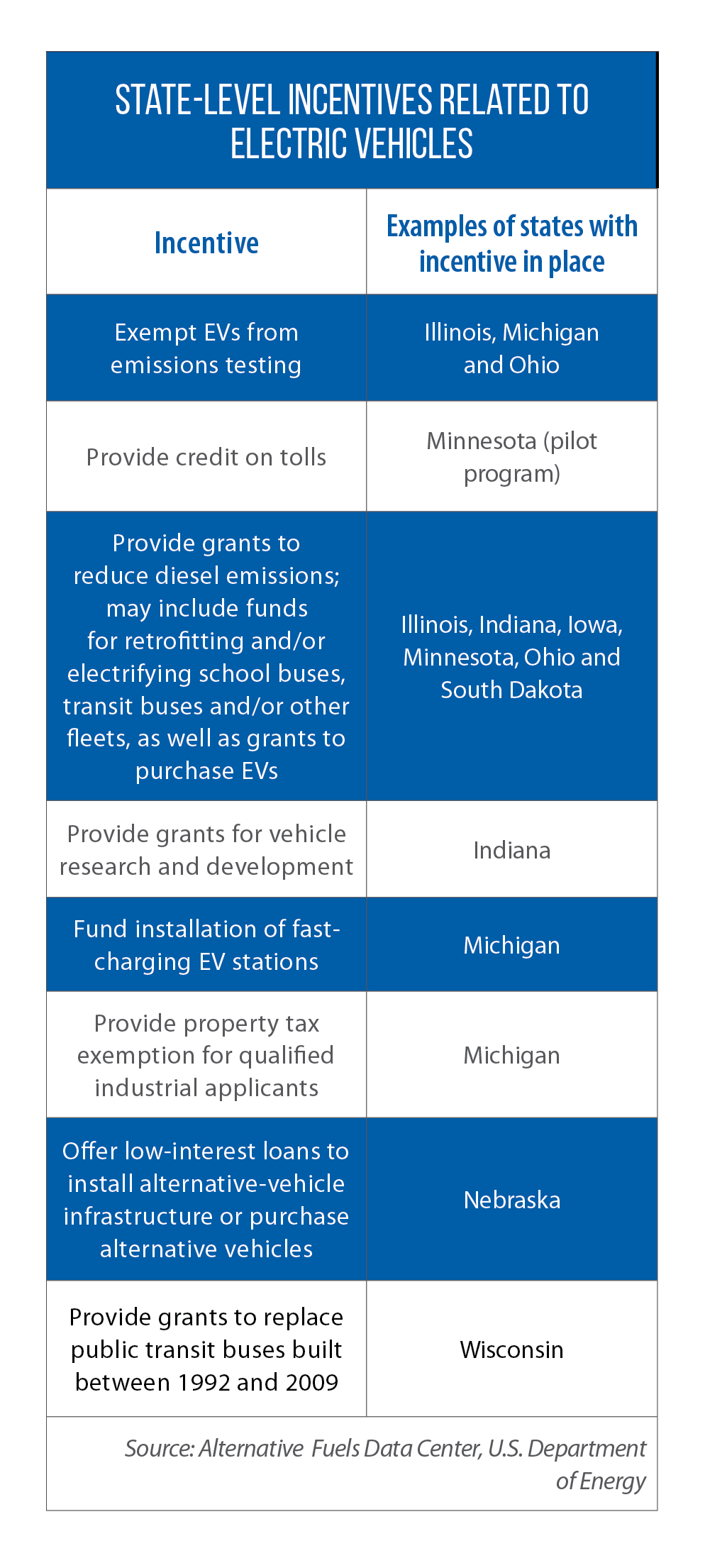

Power Up How The Midwest Is Planning And Preparing For Rise Of Electric Vehicles Csg Midwest

Learn More About The 2022 Honda Civic Central Illinois Honda Dealers

Nissan Leaf Ev Rebates Incentives Nissan Usa

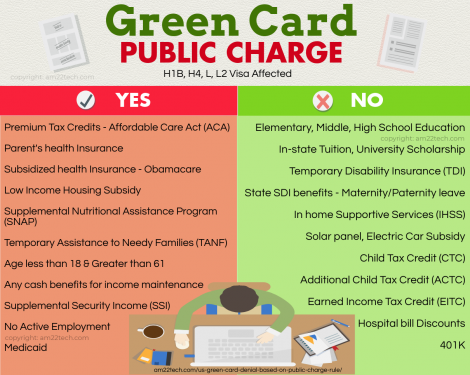

Green Card Public Charge Rule Removed H1b I485 Usa

When Are Taxes Due In 2022 Here Are All The Major Deadlines Money

Everything You Need To Know About The Solar Tax Credit Palmetto

Incentives To Buy An Electric Car Greencars

11 Electric Cars That Should Qualify For The Federal Tax Credit

Ford Lightning Ev Tax Credits Rebates Discussion Ford Lightning Forum